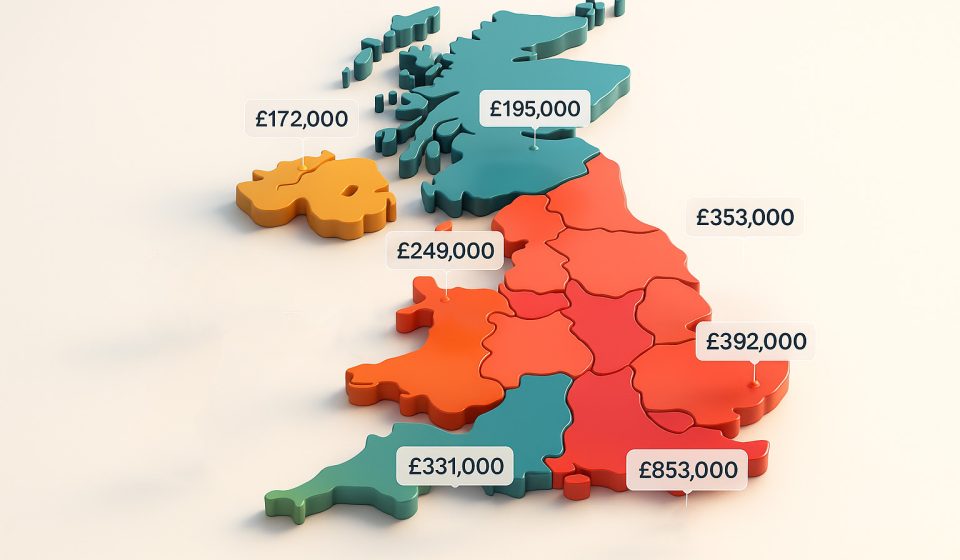

By mid-2025, the UK’s national house price conversation has quietened, but regional differences are growing sharper. Forget any talk of a single trend – the housing map now features real outliers. Some areas are keeping their heads above water. Others are slipping, quietly, beneath the surface. Whether you’re buying, investing, or just watching, the only real clarity comes from zooming in.

Table Of Content

From surprisingly resilient market towns to commuter belts now cooling, every region tells its own story. The question is, who’s resisting gravity – and who’s losing ground?

The Standouts: Where Property Prices Are Still Climbing

Growth Against the Grain

- East Midlands: Growth remains steady in Rutland, Nottinghamshire, and parts of Lincolnshire. Here, affordable entry points and a steady migration from London have kept prices ticking up, often 2–4% per year.

- Yorkshire and the Humber: While the broader region is mixed, Sheffield and smaller hotspots like Ilkley and Beverley are seeing lively price growth, powered by fresh infrastructure and targeted investment.

- South West: Second-home hunters and remote workers are still driving up values in coastal towns. Despite national headwinds, these communities remain in demand.

- West Yorkshire: Select towns are reaping the rewards of post-pandemic regeneration and robust rental demand.

London: A Tale of Two Cities

It’s never as simple as calling London a rising or falling market. Prime Central London – Chelsea, Belgravia, Knightsbridge – is holding up, buoyed by international cash and fewer mortgage-sensitive buyers. But outer boroughs are feeling the pinch. In Waltham Forest, Barking & Dagenham, and Croydon, small price drops are setting in. The divide is growing starker, with fewer transactions but vast differences between neighbourhoods.

The Cooling Zones

Where Prices Are Softening

- South East: Guildford, Reading, and much of Surrey are starting to unwind after years of rapid growth. Affordability limits have forced a market rethink.

- Scotland’s central belt: Edinburgh is pausing for breath after years of rising prices. Glasgow fares a little better, supported by regeneration, but regional momentum has slowed.

- Rental and commuter hotspots: Towns that boomed on the back of rental and commuter demand are now settling back, especially as supply and demand rebalance.

What’s Driving These Changes?

Three big factors are reshaping the landscape in 2025:

- Interest rates: Even without steep hikes, today’s base rate cools off marginal buyers and stretches affordability.

- Wages versus inflation: Real earnings have only nudged upward, keeping a lid on demand in most areas.

- Local development: The real standouts are towns with active planning, new infrastructure, or meaningful regeneration. Stagnant places lag behind.

These are not just numbers – they’re shifting how buyers think. People are looking for areas with stability, investment, and genuine long-term appeal.

Where to Watch Next?

If you’re thinking about the next five years, certain locations deserve a closer look:

- North East: Durham, Sunderland, and Teesside are undervalued, with plenty of regeneration potential.

- South Wales: Newport and Bridgend remain magnets for Cardiff’s spillover, supported by strong interest.

- Smaller cities: Worcester, Lancaster, and Shrewsbury are steadily gaining favour as remote work reshapes commuting patterns.

It’s not about chasing the fastest rise. Instead, it’s about resilience and fundamentals. In 2025, your postcode matters more than ever. Local context, not the national mood, sets the stage for growth.

Final Thought

This year’s housing story isn’t about collapse or surges – it’s about fragmentation. The market is diverging, quietly, opening up chances for those paying attention. The best strategy? Ignore sweeping headlines. Focus on places where the fundamentals stack up. If you want to know where prices are still rising, don’t look for broad trends. Look at the detail – street by street, region by region.